san antonio tax rate 2021

Avg rent for home or apartment. The 2021 rate of 276237 cents per valuation is mostly unchanged from 2020s rate of 277429 cents per 100 valuation.

Texas Sales Tax Small Business Guide Truic

Box 839950 San Antonio TX 78283.

. The minimum combined 2022 sales tax rate for San Antonio Florida is. San Antonio TX 78205 Phone. What is the sales tax rate in San Antonio Florida.

San Antonio River Authority 0018580 Alamo Community College 0149150 School Districts ISD - Alamo Heights 1193400 ISD - Boerne 1204600. The state hotel occupancy tax rate is currently 6 of the cost of a room though some. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

2021 Official Tax Rates Exemptions. Tweet TweetPhysical Address. Tax Code Section 2601214 2Tex.

The City also collects Bexar Countys 175 hotel occupancy tax on behalf of Bexar County. 2021 Official Tax Rates Exemptions Name Code Tax Rate 100 Homestead 65 and Older. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

This is the total of state county and city sales tax rates. San Antonio collects the maximum legal local sales tax. 2021 Official Tax Rates.

Taxing unit officials must adhere to specific procedures established in Truth and Taxation Laws when they adopt tax rates. 2021 NNR tax rate. The San Antonio sales tax rate is.

Thursday July 01 2021. 2020 Official Tax Rates Exemptions. San Antonio Sales Tax Rates for 2022.

The Florida sales tax rate is currently. Tax Code Section 2601214 2Tex. 1000 City of San Antonio.

School taxes typically are the major component of a homeowners annual property tax bill typically ranging from about 50 to 60 percent of the total. 48 rows San Antonio Property Tax Rates. The FY 2022 Debt Service tax rate is 21150 cents per 100 of taxable value.

If San Antonio wants to expand its current homestead exemption City Council must approve such a measure by July 1. San Antonio TX 78207. The san antonio sales tax rate is.

The current total local sales tax rate in San Antonio TX is 8250. CITIES TOTAL TAX MUNICIPAL TAX SCHOOL TAX. Monday-Friday 800 am - 445 pm.

511 Main Street Bandera TX 78003. Did South Dakota v. Divide Line 16 by Line 24 and multiply by 100.

The San Antonio Atd Transit sales tax has been changed within the last year. Set by state law the homestead exemption for all Texas independent school districts currently is 25000. In most cases the voter-approval tax rate is the highest tax rate a taxing unit can adopt without holding an election.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. The governing bodies of the taxing jurisdictions adopt a tax rate to support their fiscal year budget. These two tax rate components together provide for a total.

The process used is dependent on benchmark rates known as the effective tax rate and the rollback rate. The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund. SOUTH SAN ANTONIO ISD School Districts Name Phone area code and number School Districts Address City State ZIP Code School Districts Website Address.

The median property tax in Bexar County Texas is 2484 per year for a home worth the median value of 117100. The County sales tax rate is. The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division.

In the final phase the Tax Assessor-Collector assesses and collects property taxes for each of the taxing jurisdictions they are responsible for collecting. CITY OF SAN ANTONIO. It is a 017 Acres Lot 1259 SQFT 3 Beds 2 Full Baths in San Antonio.

The Bexar County Hospital District will see a rise in property tax revenue in the 2021 fiscal year though its tax rate will not change Bexar County Commissioners decided on Tuesday at their regular meeting. The December 2020 total local sales tax rate was also 8250. Road and Flood Control Fund.

The Fiscal Year FY 2022 MO tax rate is 34677 cents per 100 of taxable value. The sales tax jurisdiction name. The Texas state sales tax rate is currently 625.

In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law. Tax Code Section 260126. 830-796-3765 y compris toutes les taxes et tous les frais.

North Paseo Building 4th Floor Suite 4170. 2021 Official Tax Rates. 2021 Official Tax Rates Exemptions.

This years adjusted no-new. 6542 Elmer Blvd San Antonio TX 78227 is listed for sale for 259900. Divide Line 16 by Line 24 and multiply by 100.

2021 NNR tax rate. This city can afford to give more back to our homeowners in this town through a property homestead exemption Perry said noting that the city saw an increase of 20 million in property taxes from 2020 to 2021. Bexar County collects on average 212 of a propertys assessed fair market value as property tax.

825 Is this data incorrect Download all Texas sales tax rates by zip code. 2020 Official Tax Rates Exemptions. Tax Code Section 260126.

Maintenance Operations MO and Debt Service. You can find more tax rates and allowances for. For 2021 at their meeting on october 26 2021 the alamo colleges districts board of trustees approved the proposed property tax rate of 014150 0107760 for maintenance operations and 004139 for debt service per 100 of valuation.

Bexar County has one of the highest median property taxes in the United States and is ranked 282nd of the 3143 counties in order of. The rates are given per 100 of property value. There is no applicable county tax.

SAN ANTONIO ISD School Districts Name Phone area code and number School Districts Address City State ZIP Code School Districts Website Address. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. The property tax rate for the City of San Antonio consists of two components.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Tax Rates Bexar County Tx Official Website

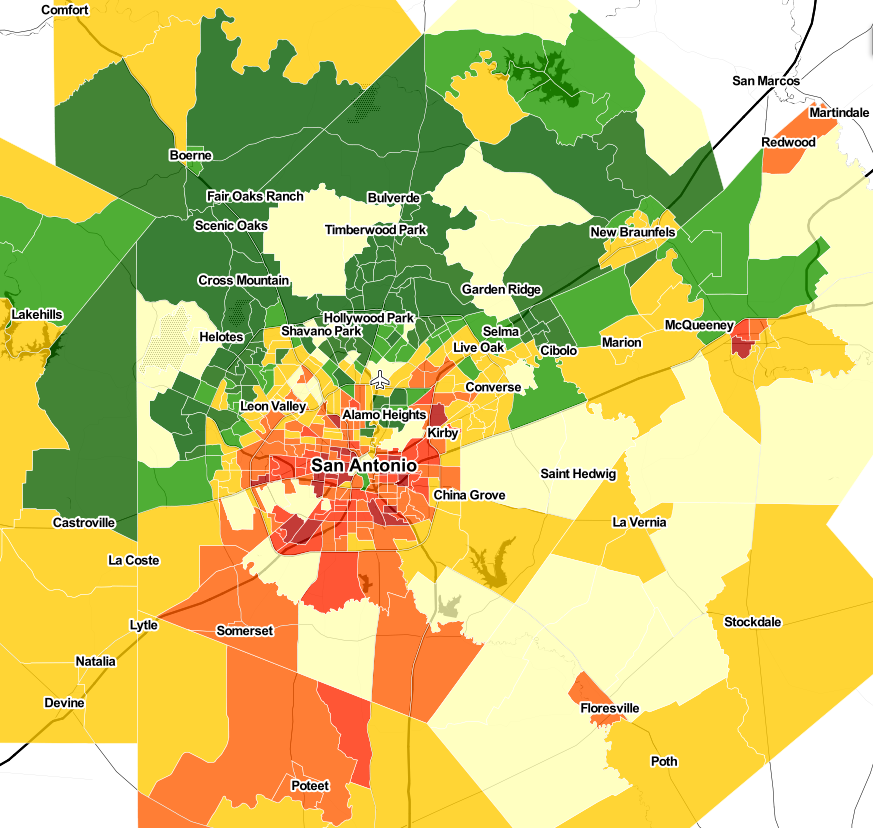

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Texas Sales Tax Guide For Businesses

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

San Antonio Could Roll Back Its City Property Tax Rate Due To Higher Projected Revenues Tpr

County Commissioners Vote To Decrease Property Tax Rate In 2022

Hotel Occupancy Tax San Antonio Hotel Lodging Association

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

San Antonio Property Tax Rate Cut Homestead Exemption Increase Mulled

Texas Senate Eyes Elimination Of Isd Maintenance Operations Property Tax Rate The Texan

San Antonio Real Estate Market Stats Trends For 2022

What Is The San Antonio Sales Tax Rate The Base Rate In Texas Is 6 25